By Kelsey Moore, Director of Economic Development & Special Projects at Georgia Screen Entertainment Coalition

Since the introduction of the film tax incentive, Georgia has gained prominence as one of the leading film and television production hubs in the world—attaining this status in a time of major competition across the United States and globally. A newly released study takes a comprehensive look at the economic impact of the tax incentive and the role it plays in Georgia’s success.

The findings from the nine-month expanded economic study are based on unprecedented access to new data; extensive qualitative and quantitative research; and sector-specific IMPLAN modeling, a robust economic modeling tool widely used over the past 40 years by local governments, business professionals and academics to analyze economic development policies and programs.

The study found that less than 8% of Georgia’s production activity would have occurred without the film tax credit. Measuring activity that occurred only due to the tax incentive, the study found significant returns for the state of Georgia.

Opportunity and Jobs for Georgians

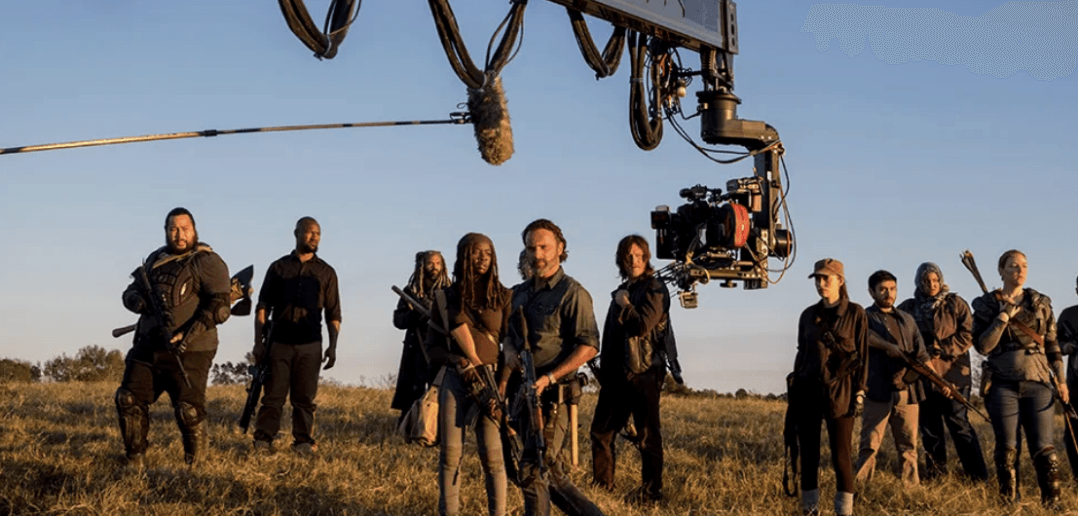

Georgia’s investments in the film industry boosted its position as a global leader in the creation of digital entertainment and related opportunities that come with it.

Today, Georgia workers—and students—can pursue training and highly desirable, well-paying jobs that keep intellectual property and talent in the state. The tax credit fuels thousands of jobs for hardworking Georgians, creating jobs that range from electricians and construction workers to digital artists and computer programmers. Families and small businesses throughout the state count on the opportunities created by the tax credit.

Studio and Stage Space

Keeping Georgia’s film tax incentive stable is key to capitalizing on studio construction investment and jobs.

From 2012-2022, the tax incentive spurred $1.28 billion in studio construction, an investment that 94% of studio owners say would not have gone forward in the absence of the tax credit. It’s notable that investment and spending on studio construction itself is not eligible to receive the film tax credit.

There also is significant studio construction investment planned in the coming years—nearly $3 billion—and studio owners confirmed that 100% of the investment is dependent on a stable tax incentive.

The benefits of studio construction are significant for local communities and jobs:

To read more features, visit the Creative Economy Journal.